Present value factor calculator

5000 then it is better for Company Z to take money after two years otherwise take Rs. Present Value Formula and its Explanation.

Calculating Present Value Accountingcoach

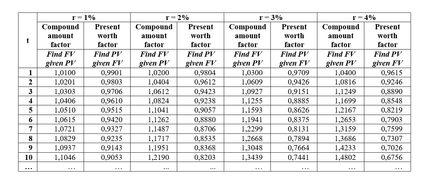

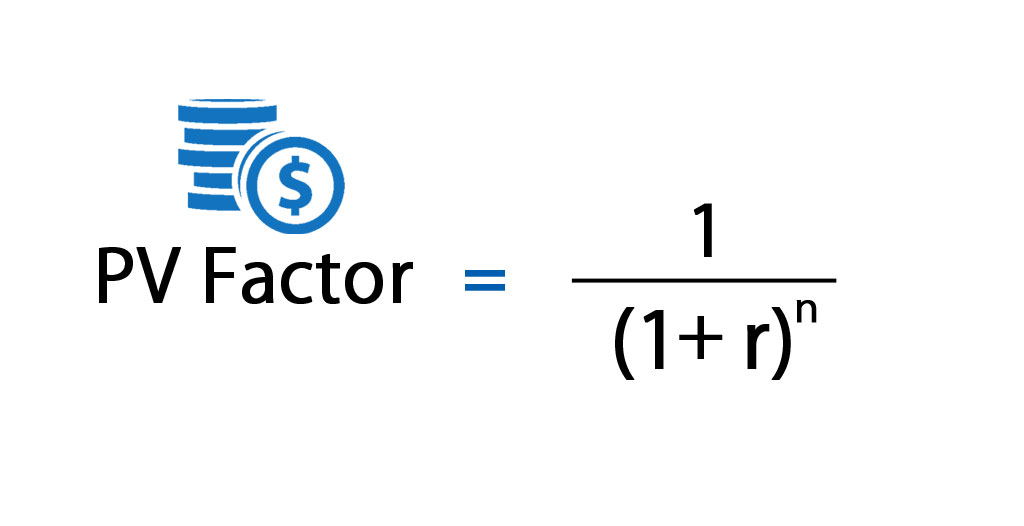

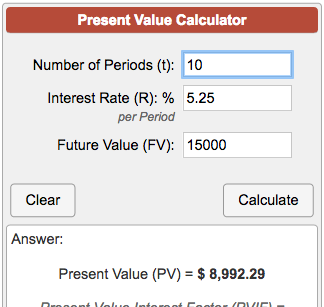

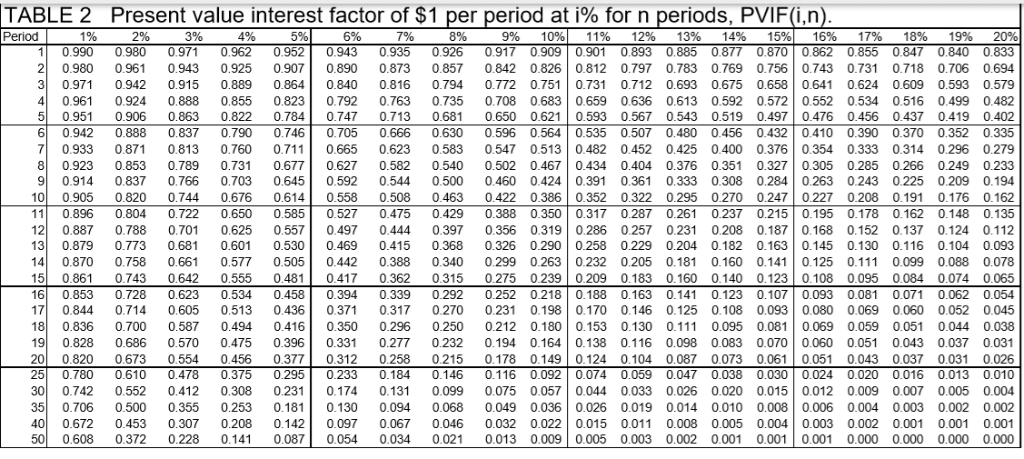

It is a factor used to calculate an estimate of the present value of an amount to be received in a future period.

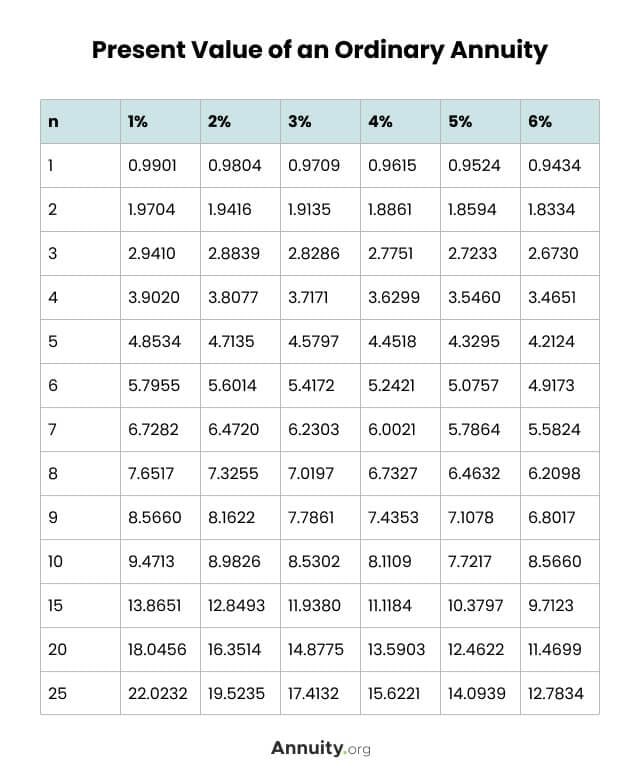

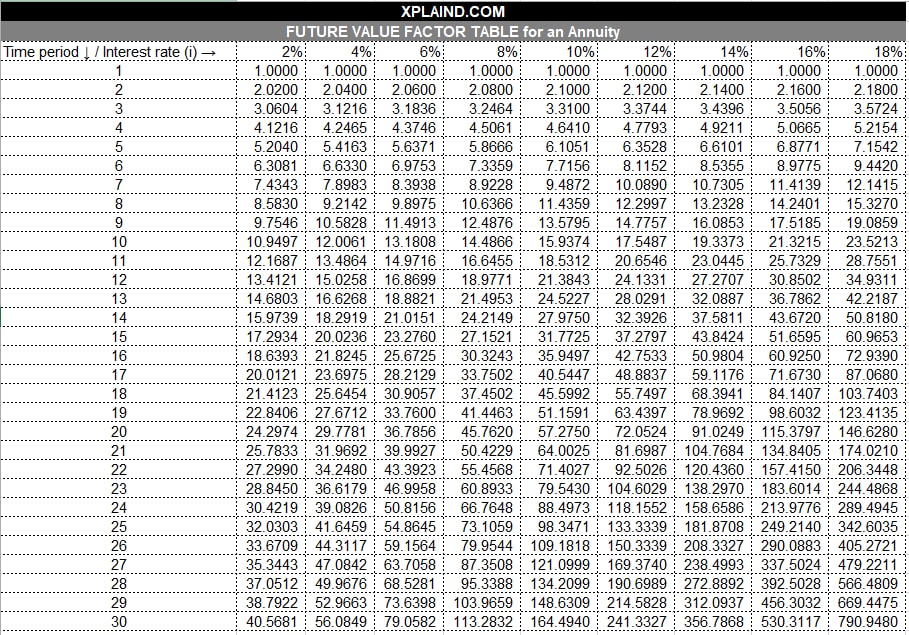

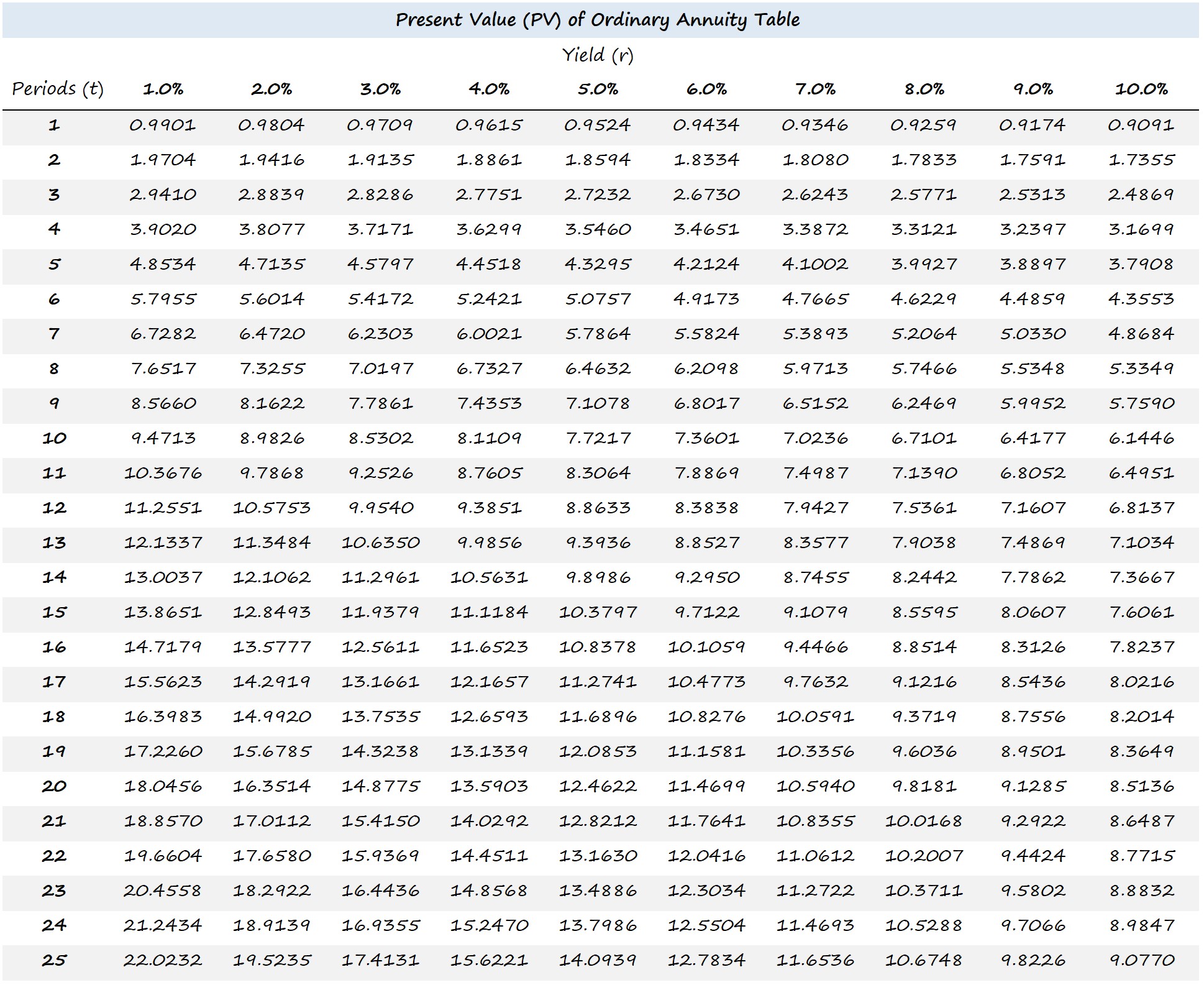

. For example an individual is wanting to calculate the present value of a series of 500 annual payments for 5 years based on a 5 rate. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. Future Value Factor FVF Calculator Perpetuity Yield PY Present Value of Perpetuity PVP and Perpetuity Payment PP Calculator Present Value PV and Future Value FV Number of Periods Calculator.

Graph and present your scientific work easily with GraphPad. This calculation process of present value is known as discounting and the sum arrived at after discounting a future amount is known as Present Value. The present value factor is the factor that is used to indicate the present value of cash to be received in the future and is based on the time value of money.

This is a guide to Present Value Formula. The net present value calculator exactly as you see it above is 100 free for you to use. Use this calculator to compute a two-tailed P value from any Z score T score F statistic correlation coefficient R or chi-square value.

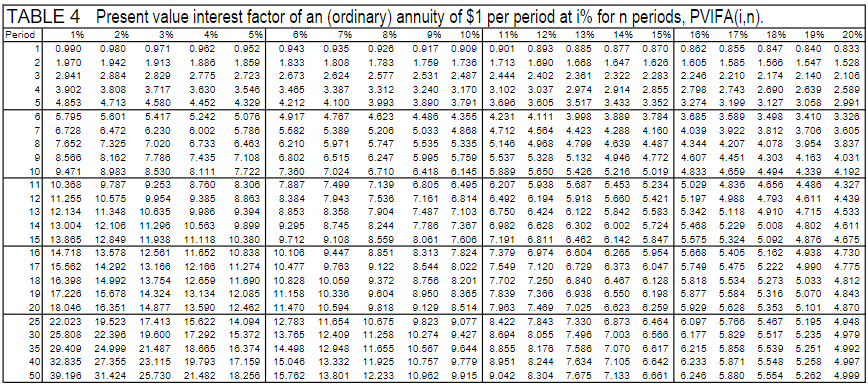

This is the present value per dollar received per year for 5 years at 5. PMBOK 6th edition part 1 ch. 5500 is higher than Rs.

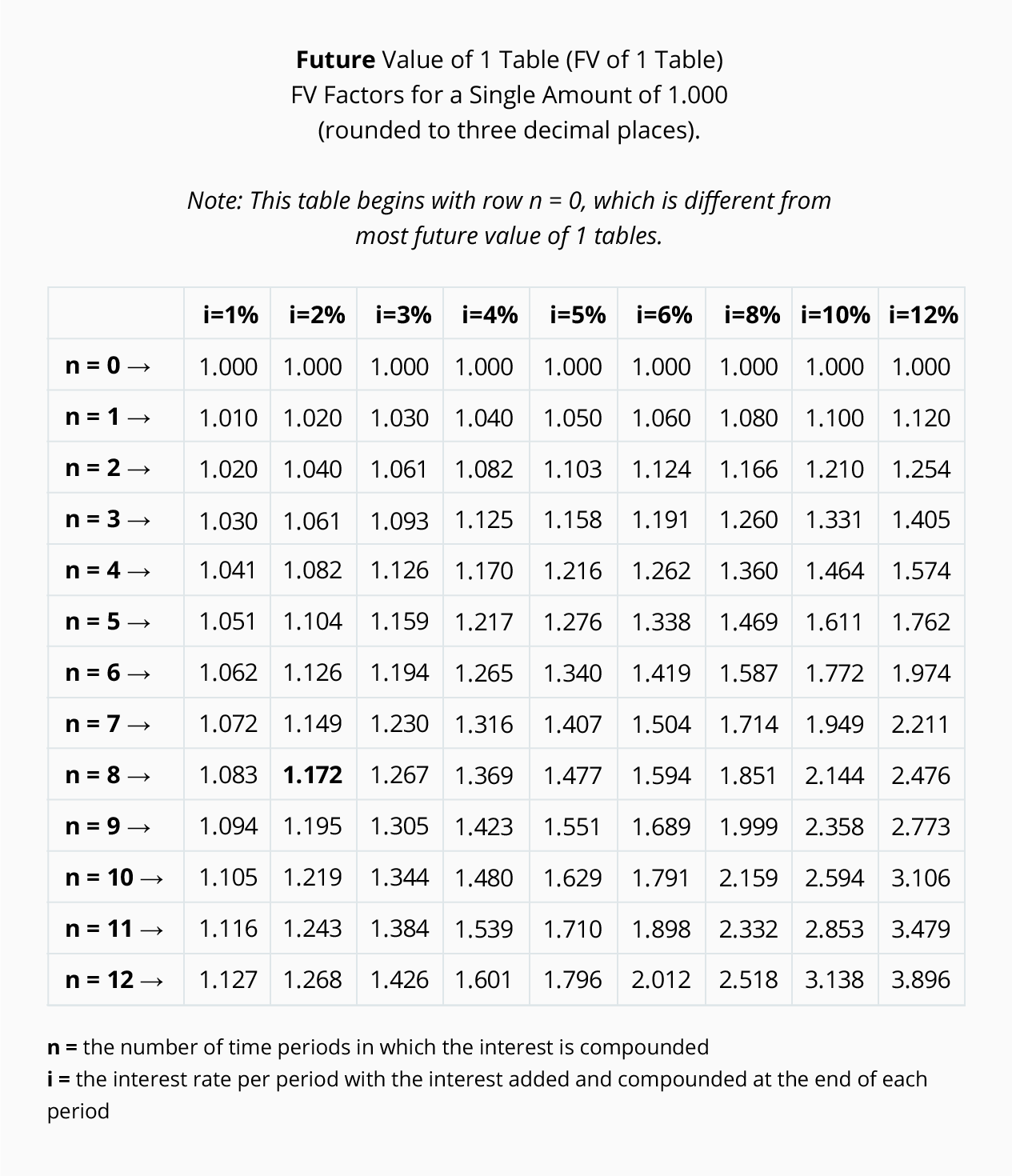

If you have 1000 in the bank today then the present value is 1000. If youd like to know how to estimate compound interest see the article. The Present Value Interest Factor includes time period interest rate and compounding frequency.

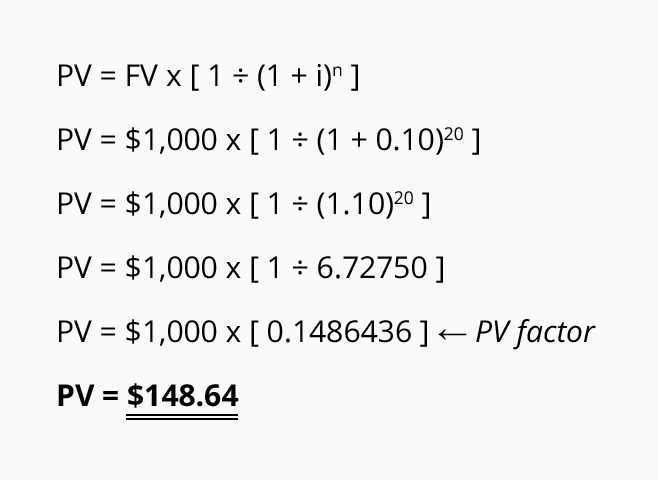

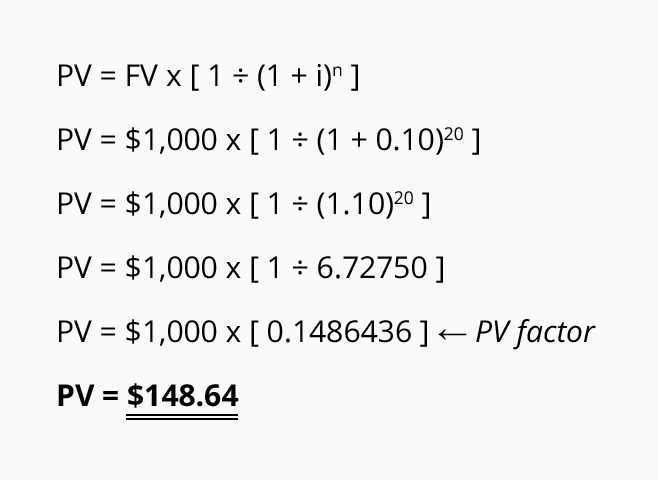

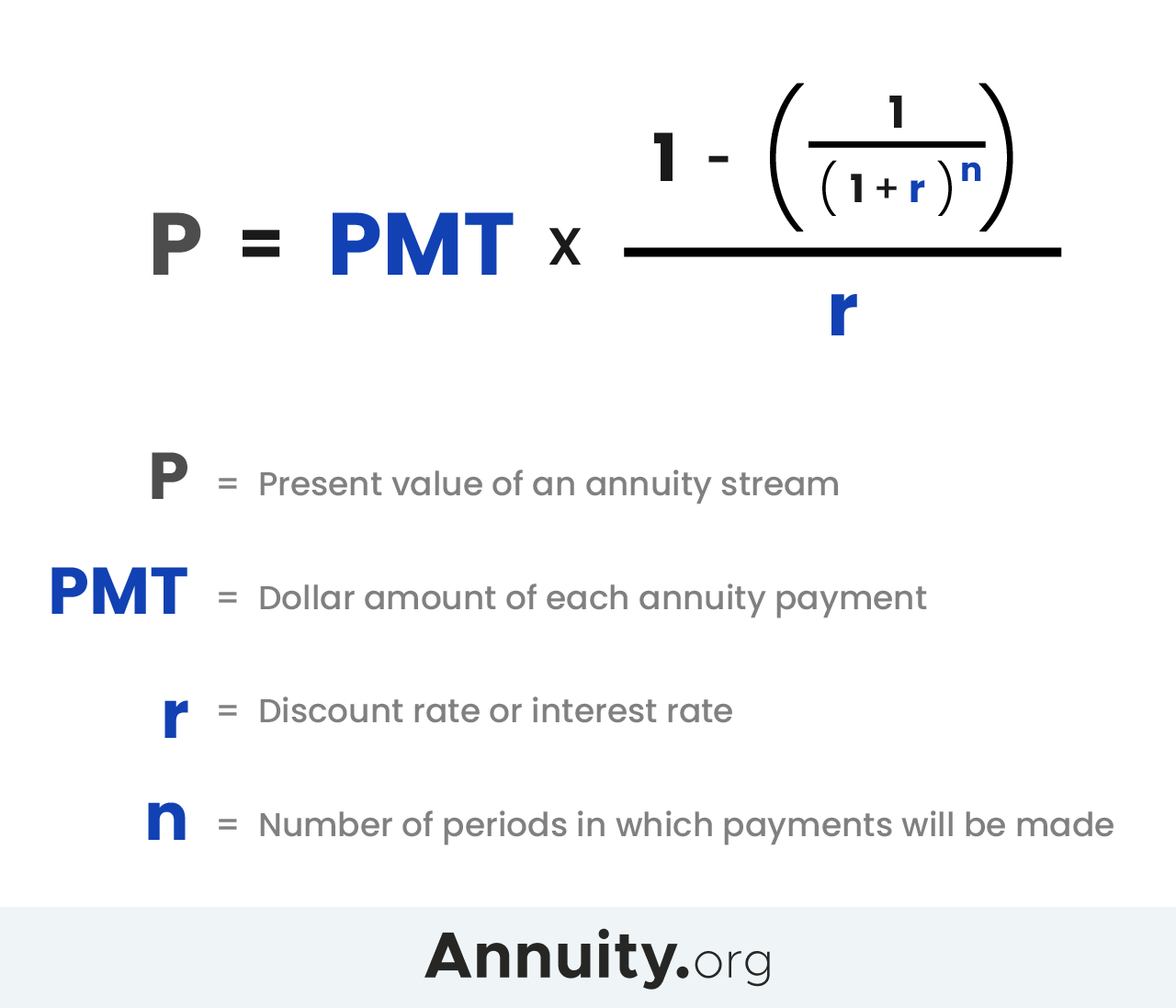

This PV factor is a number that is always less than one and is calculated by one divided by one plus the rate of interest to the power ie the number of periods over which payments. The present value formula applies a discount to your future value amount deducting interest earned to find the present value in todays money. How to Calculate Net Present Value.

Present Value Example Problem. By looking at a present value annuity factor table the annuity factor for 5 years and 5 rate is 43295. If you kept that same 1000 in your wallet earning no interest then the future value would decline at the rate of inflation making 1000 in the future worth less than 1000 today.

PVIF is the abbreviation of the present value interest factor which is also called present value factor. Enter the current market price of the share. In project management the NPV is commonly used and also listed in PMIs Project Management Body of Knowledge source.

You may also look at the following articles to learn more Guide to Present Value Factor Formula. Where PVPresent value or the principal amount. Type in the current AAA corporate bond yieldThe current AAA corporate bond yields in the United States are about 422.

Future cash flows are discounted at the discount. The calculator first converts the number of years and. See How Finance Works for the compound interest formula or the advanced formula with annual additions as well as a calculator for periodic and continuous compounding.

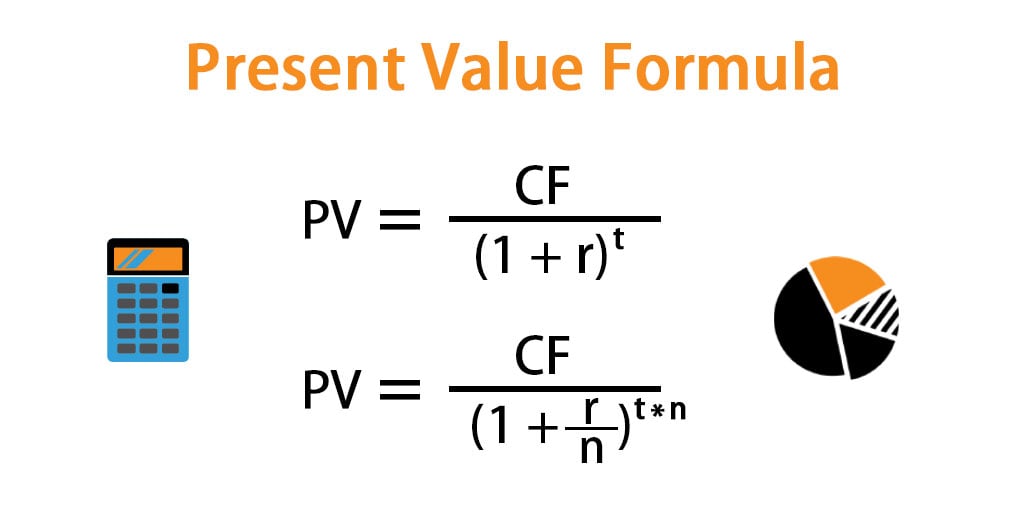

The present value of receiving 10000 at the end of five years when the compounding is semiannual requires that n 10 5 years X 2 semiannual periods per year and that i 3 6 per year two semiannual periods in each year. The most important factor that has an impact on present value is interest or discount rate. Present Value Formula and Calculator The present value formula is PVFV1i n where you divide the future value FV by a factor of 1 i for each period between present and future dates.

Here we have discussed How to Calculate Present Value along with practical examples. 5000 today or Rs. You can apply this factor to other future value amounts to find the present value with the same length of investment interest and compounding rate.

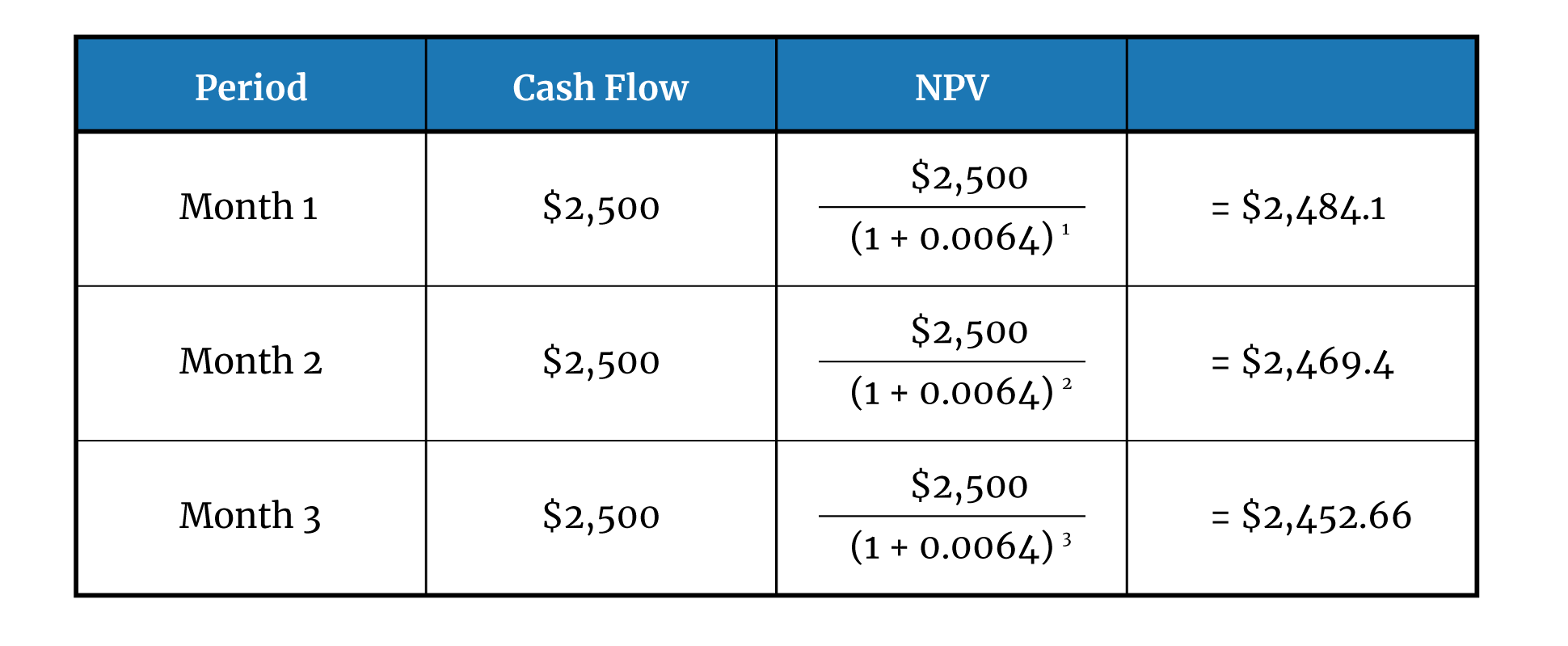

Examples of Variance Analysis Formula. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. When you perform a cost-benefit analysis and need to compare different investment alternatives with each other you might consider using the net present value NPV as one of the profitability indicators.

Within this automatic NPV calculator you are able to enter up to 10 separate cash flows to factor in. To give an example there can be two situations first. Let us see how to calculate the intrinsic value of a stock using our online intrinsic value calculator.

Enter the earnings per share of the company. PV FV 11r n. Rate Per Period As with any financial formula that involves a rate it is important to make sure that the rate is consistent with the other variables in the formula.

Whether Company Z should take Rs. With ANOVA they are used to analyze if some potentially predictive factor has an impact on the response variable. PV FV 1r n.

We also provide a Present Value Calculator with a downloadable excel template. Use the Present Value of Cash Flows Calculator to calculate the present value of fixed or changing cash flows to allow insight into future profits based on current costs and known interest rates. Type the number into a text editor with no formatting and copy from there then you can paste the value into the calculator and the number will be autoformatted.

Present Value - PV. Input the expected annual growth rate of the company. Present Value Of An Annuity.

Use the PV of 1 Table to find the rounded present value factor at the intersection of n 10 and i 3. There is a workaround. The present value is simply the value of your money today.

Now in order to understand which of either deal is better ie. The present value of annuity formula relies on the concept of time value of money in that one dollar present day is worth more than that same dollar at a future date. 5500 on the current interest rate and then compare it with Rs.

The formula to calculate the present value is as follows. Not ideal but it does. 5500 after two years we need to calculate a present value of Rs.

5000 if the present value of Rs. The calculator only expects users to type numbers only and the calculator takes care of formatting the numbers with thousands separators. The future cash flows of.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999.

Net Present Value Calculator With Example Steps

Solved Table 4 Present Value Interest Factor Of An Chegg Com

Capital Expenditure Report Template 1 Professional Templates Budget Template Free Budget Template Excel Budget Template

Future Value Factor Forex Education

Present Value Formula Calculator Examples With Excel Template

Compound Interest Calculator With Formula

What Is An Annuity Table And How Do You Use One

Present Value Calculator

Profitability Index Formula Calculator Excel Template Regarding Net Present Value Excel Template Excel Templates Agenda Template Meeting Agenda Template

Present Value Factor Formula Calculator Excel Template

Future Value Annuity Due Tables Double Entry Bookkeeping Time Value Of Money Annuity Table Annuity

Present Value Calculator Basic

Future Value Factor Of A Single Sum Or Annuity

Future Value Factors Accountingcoach

Annuity Present Value Pv Formula And Calculator Excel Template

Present Value Of An Annuity How To Calculate Examples

Solved Table 4 Present Value Interest Factor Of An Chegg Com